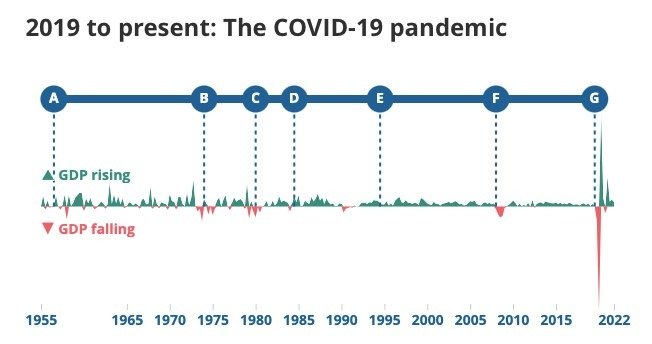

The UK economy was profoundly impacted by implementing a nationwide lockdown in response to the COVID-19 pandemic, resulting in a significant decline in the country’s Gross Domestic Product (GDP). The measures taken to prioritize public health, such as social distancing, travel restrictions, and the closure of non-essential businesses, caused a staggering 19.8% decrease in GDP between April and June 2020. Household spending experienced an unprecedented drop of over 20% during this period, marking its most significant quarterly contraction ever recorded. The decline in spending can be attributed to reduced expenditures on sectors heavily affected by the pandemic, such as restaurants, hotels, transportation, and recreational activities.

Unprecedented Decline in Influential Factors during Lockdown

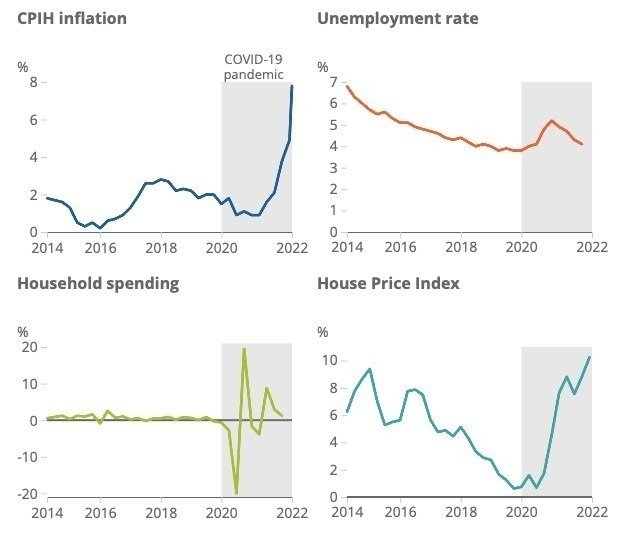

To put it into perspective, the spending decline during the first COVID-19 lockdown was unparalleled, with a record-breaking 20% decrease. Other factors such as the Consumer Price Index Including Housing (CPIH) inflation, the unemployment rate among individuals aged 16 and over, quarterly changes in household expenditure, and the House Price Index’s 12-month percentage change from 2014 to 2022 were also influential during this period, alongside the economic impact.

GDP fall and household spending decline in the UK

In response to the COVID-19 pandemic, the UK implemented a nationwide lockdown that resulted in an unprecedented decline in the country’s GDP. Public health measures such as social distancing travel restrictions, and the closure of non-essential shops led to a significant 19.8% decrease in GDP between April and June 2020. Additionally, household spending experienced a substantial drop of over 20%, marking the most significant quarterly contraction ever recorded. The decline was primarily driven by reduced expenditures on sectors, including restaurants, hotels, transportation, and recreation. Furthermore, economic indicators such as the CPIH inflation quarterly percentage change, the unemployment rate among individuals aged 16 and over, quarterly changes in household expenditure, and the House Price Index’s 12-month percentage change from 2014 to 2022 played influential roles during this period.

Addressing Investment Concerns and Energy Security

According to industry sources, the British government is set to announce revisions to its windfall tax on oil and gas companies on Friday. These changes aim to address concerns regarding the impact on investments and energy security. Under the proposed adjustments, called the Energy Profits Levy (EPL), the tax will not be applied if oil or gas prices fall below their 20-year average for an extended period. The Treasury is expected to reveal these revisions on Friday morning after consultations. Although the spokesperson for the Treasury declined to comment, it is worth noting that the government previously introduced a 25% levy on oil and gas producers, which was later increased to 35% in November, resulting in one of the highest tax rates globally for the sector at 75%.

Sunak Faces Challenges in Addressing Rising Prices and Energy Subsidies

New Chancellor Rishi Sunak enters office with caution, having made few promises during his campaign. The rapid increase in prices is a crucial concern. Addressing the Energy Price Guarantee, a subsidy program for high energy bills poses a challenge. Initially planned for two years, the previous Chancellor shortened the scheme. Sunak remains cautious about extending it, despite projected household energy bills exceeding £4,000 in spring, leading to Inflation. Sunak’s commitment to increasing benefits, tax credits, and pensions in line with 10.1% inflation is uncertain due to a £30-40 billion borrowing gap. However, market trust lowers borrowing costs, potentially offering favourable mortgage rates and a smaller interest rate hike by the Bank of England.

Raising Concerns over Economic Management

The interest rate on short-term UK Government borrowing, known as two-year gilt yields, experienced a rise of more than 0.2 percentage points on Tuesday. Currently at 4.83%, this marks the highest level since the 2008 financial crash. Interestingly, it also indicates that the yields are now higher than they were following Liz Truss’s unsuccessful mini-budget. Stewart Hosie, SNP MP and the party’s economy spokesperson, criticized Chancellor Rishi Sunak for perpetuating Truss’s legacy of economic incompetence. Hosie highlighted the adverse impact on households due to the government’s failure to control interest rates and Inflation. He attributed this situation to the Tories’ Brexit obsession, which has led to the UK’s underperformance in the G20 economies. Hosie emphasised the need for independence to escape Westminster’s control and the Tories’ economic mismanagement.

Economic Outlook with 0.4% Growth in the UK for 2023

The CBI has revised its UK economic forecast, shifting from a projected 0.4% contraction to a 0.4% growth in 2023. The Outlook for 2024 also sees a slight increase to 1.8% growth. Factors contributing to this shift include falling Inflation due to lower wholesale energy prices and the reopening of China’s economy post-COVID-19. However, challenges persist, including the cost of living crisis, stagnant business investments, and underperforming exports. The forecast predicts two more interest rate increases by the Bank of England, with household spending and residential investments expected to recover gradually. Private sector capital spending remains relatively weak compared to other G7 nations.