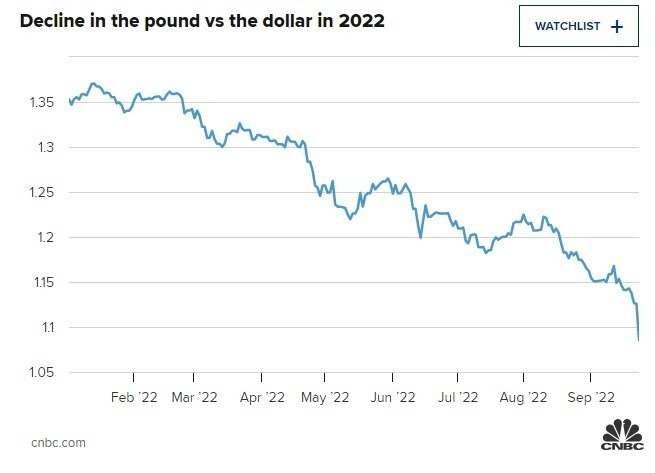

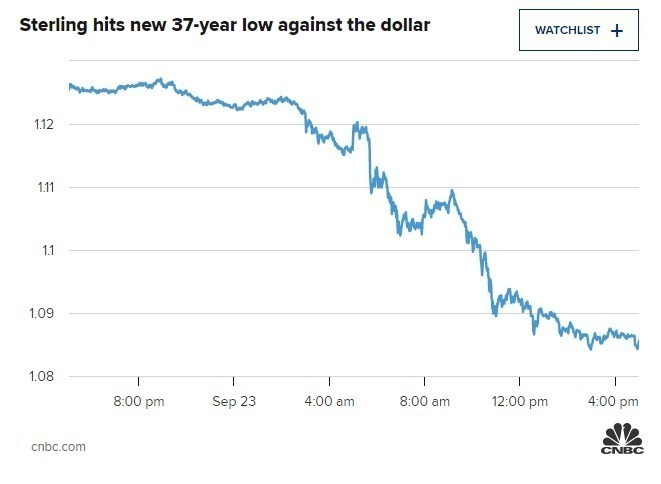

The pound has fallen more than 3% versus the dollar as of 4 p.m. London time on Friday, reaching a new high of $1.0915.

It last briefly reached this level in 1985, when it declined as a result of increases in U.S. interest rates.

Although the newly elected prime minister of the United Kingdom, Liz Truss, made much of ” trickle down economics “[1] during her campaign this summer, no one could have foreseen the wave of tax cuts that were released only a few weeks into her Downing Street tenure.

Her Finance Minister Kwasi Kwarteng billed Friday’s economic speech as a “mini-budget,” yet it contained a level of tax cuts not seen in Britain since 1972.

With inflation boiling over and a cost-of-living crisis advancing into Europe, Truss, whose “Trussonomics” policy stance has been compared to that of her political idols Ronald Reagan and Margaret Thatcher, has now set the nation on an economic path completely at odds with most, if not all, major global economies.

Even some of her supporters have criticised it as a political and financial risk given that Truss hasn’t yet run against the entire British voters in a general election, unlike her predecessor Boris Johnson.

Market analysts projected right away that Britain would need to issue more bonds and take on more debt to pay for the cutbacks, which was uncharacteristic of previous low-tax Conservative regimes.

Investors avoided the country’s assets on Friday, sending the U.K. bond markets into a spiral. The 5-year gilt’s yields, which move inversely to prices, increased by half a percentage point, according to Reuters, the biggest one-day increase since at least 1991.

Sterling was also pushed into a wild fall when bonds collapsed, having just fallen to its lowest level versus the dollar in 37 years. It lost close to 3.6% of its value versus the dollar on Friday. It dropped 5% for the week and has lost 27% since immediately before the 2016 Brexit vote.

For the first time ever, Wall Street banks are seriously considering breaking below parity with the U.S. dollar, and several observers have compared the pound to an emergency market currency.

Left-leaning On its front page on Saturday, The Guardian daily referred to it as “a budget for the rich” while The Times referred to it as a “great tax gamble.” While hesitating to comment on the currency movements, Kwarteng himself claimed it was a “very good day for the U.K.,” and the right-wing Daily Mail tabloid referred to it as a “true Tory budget”

In a research report, ING analysts stated that investors are concerned about the U.K.

As a result of the Treasury’s current commitment to open-ended borrowing for these tax cuts, the Bank of England will be forced to respond by raising interest rates more vehemently.

According to ING’s Senior Rates Strategist Antoine Bouvet and Global Head of Markets Chris Turner, “To us, the magnitude of the jump in gilt yields has more to do with a market that has become dysfunctional,”

“A number of indicators … suggest that liquidity is drying up and market functioning is impaired. A signal from the BOE that it is willing to suspend gilt sales would go a long way to restoring market confidence, especially if it wants to maximise its chances of fighting inflation with conventional tools like interest rate hikes. The QT [quantitative tightening] battle, in short, is not one worth fighting for the BOE,” they added, referencing the Bank’s move to normalise its balance sheet after years of stimulus.

The top three rating agencies’ long-term sovereign outlook for the United Kingdom is now steady, but there is a “risk of a probable move to a negative outlook” when they are evaluated, according to ING (Oct. 21 and Dec. 9).

The “price of loose fiscal policy was laid plain by the market” on Friday, according to Deutsche Bank analysts.

″[Friday’s] market moves suggest that there may be a credibility gap,” Sanjay Raja, a senior economist at Deutsche Bank, said in a research note.

“A plan to get the public finances on a sustainable footing will be necessary but not sufficient for markets to regain confidence in an economy sporting large twin deficits [the U.K.’s fiscal and current account balances],” he added.

“Crucially, with fiscal policy shifting into easier territory, the onus may now fall on the Bank of England to stabilise the economy, with the MPC [Monetary Policy Committee] having more work to do to plug the gap between expansionary fiscal policy and tightening monetary policy.”

According to the LONDON — experts at Citi, the U.K. is at risk of a currency crisis that might cause sterling to equalise with the dollar.

The largest tax cut package in decades was unveiled by the British government on Friday morning, as Treasury officials were aiming for a 2.5% trend in growth, according to Finance Minister Kwasi Kwarteng. British economic growth has been slow recently, and the Bank of England said on Thursday that the country was probably experiencing a recession.

Government bond yields rose at the fastest daily rate in more than a decade as traders appeared to panic over the possibility of the U.K. increasing its already record-high debt-to-GDP ratio as it spends additional billions on economic support for households and businesses amid the European energy crisis.

The pound has fallen more than 3% against the dollar by 4 p.m. London time on Friday, hitting a new 37-year low of $1.0915. It last briefly reached this level in 1985, when it declined as a result of increases in U.S. interest rates.

According to analysts, there is now a considerable likelihood that the currencies will reach parity for the first time ever. The all-time low for sterling is about $1.05.

According to analysts, there is now a considerable likelihood that the currencies will reach parity for the first time ever. The all-time low for sterling is about $1.05.