The UK energy market is in crisis mode – here’s why prices are rising.

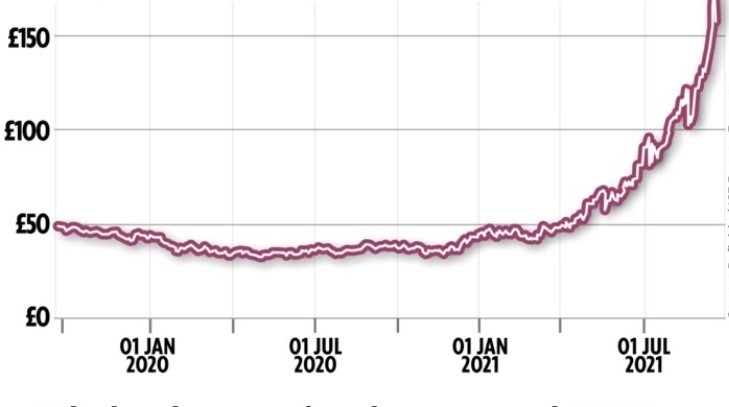

Wholesale gas prices have gone up a staggering 250% since the start of the year, and 70% since August.

Gas prices spike: How UK government failures made a global crisis worse

The UK government has been in emergency talks with leaders from the energy industry as gas prices (and with them, electricity prices) have soared to more than four times the level they were in a similar period in 2020.

Concerns are growing about the security of winter gas supplies, and industries reliant on gas, such as the fertiliser industry, are curtailing production, threatening various supply chains. Consumers are facing significant price increases and the energy regulator Ofgem has already had to raise its price cap, and may have to do so again.

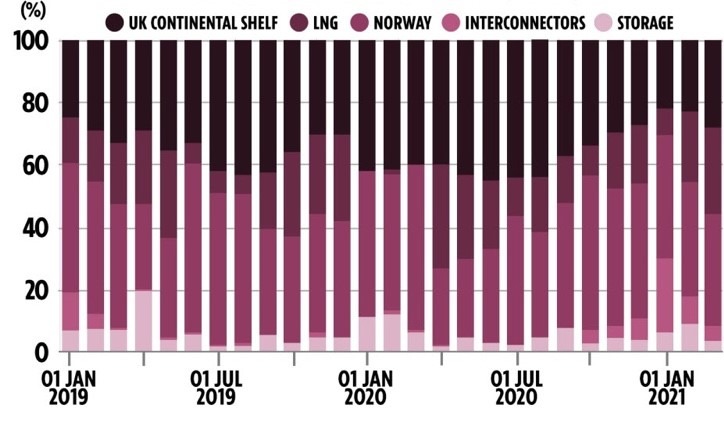

Some smaller energy companies have gone out of business and others may follow. Amid all this, the government continues to maintain that the UK benefits from a diversity of sources of supply of natural gas. This is true, but it obscures the nature of the problem facing the country.

The UK currently has very modest amounts of storage – less than 6% annual demand. In Germany, France, and Italy, storage covers about 20% of annual demand. So where does all this leave UK gas security? The government published a study in 2017 which found that the UK’s energy system could weather a prolonged disruption to global LNG supply and supplies of Russian gas and maintain domestic gas demand if “consumers are willing to pay for it”. The researchers did not think it likely that both shocks would happen simultaneously, yet this is just what has happened. Although it is unlikely to last for a long time, it will affect prices in the coming winter.

The UK Gas Price Crisis

In the past few weeks, UK utilities have reached crisis point over the price of gas. Consistent rises in wholesale prices have made their business unprofitable, with no ability to pass costs on.

The chain of events begins with the pandemic, and the fall in wholesale energy prices that came with it. As Covid-19 hit the UK, the country’s gas and electricity use fell sharply.

This mirrored low demand in other countries, and when met with overproduction from oil and gas companies, prices plummeted. Smaller energy firms took this opportunity to lower price, in an effort to attract new customers. This meant lower profit margins than large companies, which barely changed their tariffs.

As gas supply fell and demand started recovering, wholesale began to rise. This continued past pre-pandemic prices, reaching a new high level in the last few weeks. Going from record-lows to record-highs has led forward contracts to almost double in price over the past year. Day-ahead gas contract have gone from £0.12 per therm to over £0.90 per therm in 15 months.

Energy Companies Sound the Alarm on UK Gas Crisis

The first warnings of financial difficulties for suppliers came in mid-September. Ahead of a rise in energy price caps, Ofgem warned that consumer energy bills would quickly follow. In the following days, to small utilities collapsed, affecting approximately 570,000 people.

One of the UK’s largest power stations, Drax, has offered to extend the use of its coal-fired turbines to take some pressure away from gas-fired plants.

Why have gas prices gone up?

Rising energy costs explained,and how it could impact food supply and bills

Soaring gas prices have plummeted the UK into an energy crisis, with fears over whether the poorest households will be able to heat their homes this winter.

Energy companies are struggling to stay afloat, with some – including Utility Point and People’s Energy – already going bust.

The government is exploring ways to support the UK’s most vulnerable households this year, while it considers offering state-backed loans to encourage surviving energy companies to take on customers from firms that have gone bust.

Natural Gas Uses

- Gas is a vital part of the economy providing heat, electricity and raw materials.

- Natural gas is a vital feedstock in the manufacturing sector.

- Natural gas currently provides more than 84% of the heating needs and around 40% of the electricity generation.

- Oil and natural gas provide the energy source or raw material to make a wide range of products and plastics.

- Gas is also important for balancing out the increasing levels of intermittent and inflexible low carbon energy on the system.

- Natural gas is also a key component in the manufacture of fertilisers.

- The Haber-Bosch process uses natural gas to provide hydrogen, which is combined with nitrogen in air as part of the process to create ammonia. Ammonia is a vital ingredient for other nitrogen based fertilisers.

Why Are Gas Prices Rising in the UK?

A variety of factors over the past few weeks has led to gas and energy prices surging ahead of Christmas, the price of wholesale gas has surged by 250% since the beginning of the year. Since August this has further increased by 70%, according to figures from Oil & Gas UK.

There are many factors involved in the increased price of gas, one of which is the economy opening up from the pandemic, increasing demand for gas.

Furthermore, Europe is about to start entering winter, when gas demand will be highest, especially from countries such as the UK which overwhelmingly rely on gas to heat homes.

Other factors contributing to the price surge is supply from Russia recently drying up while demand in Asia is high, increasing the pressure on international markets.

In the UK, several gas platforms in the North Sea have closed to perform maintenance that was paused during the pandemic.

Where Does UK Gas Come From?

The UK has been a big producer of gas since the mid-1960s, but output has fallen since 2000 and usage continues to rise. The UK now imports more than half its gas – much of it from Norway, and a considerable amount from the Netherlands and Belgium.

Liquid natural gas (LNG), transported by ship from the likes of Qatar, has been increasingly in demand in the UK, but there is competition for supplies from the likes China.

Russia has been accused of restricting supply for political reasons (It wants to build a controversial pipeline across the Baltic Sea). But this would probably not have a big effect on the UK as it supplies less than 5% of its gas.

“The UK Imports Two-Thirds of its Natural Gas”

Russia Accused of Rigging Gas Prices to Undermine Britain’s Economic Recovery

State-owned Gazprom accused of market manipulation, which threatens to plunge UK food supply chain into chaos

Russia state-owned energy corporation, which runs this oilfield in the Republic of Tatarstan, has been accused of “Deliberate market manipulation”

Russia has been accused of increasing gas prices in a bid to undermine British and EU economies

US blames Russia for manipulating Europe gas prices, Moscow retorts the EU messed it up euractive.com

A group of more than 40 members of the European Parliament has written a letter accusing Russia’s Gazprom of manipulating gas prices.

They see a diminishing flow of Russian gas through Ukraine as an attempt by Moscow to force Germany to approve activation of a newly completed gas pipeline through the Baltic Sea, Nord Stream 2. Gazprom denies the accusation. IEA says Russia could do more to supply Europe with gas.

The International Energy Agency (IEA) said on Tuesday (21 September) Russia could do more to help alleviate gas supply issues in Europe which have driven prices up to record highs over the past month.

While the EU is struggling, the situation is far worse in former EU member Britain, where wholesale energy prices are outstripping even those soaring in the rest of Europe.

The United States is also seeing an increase in energy prices, but is largely shielded because of gas production from its shale fields.