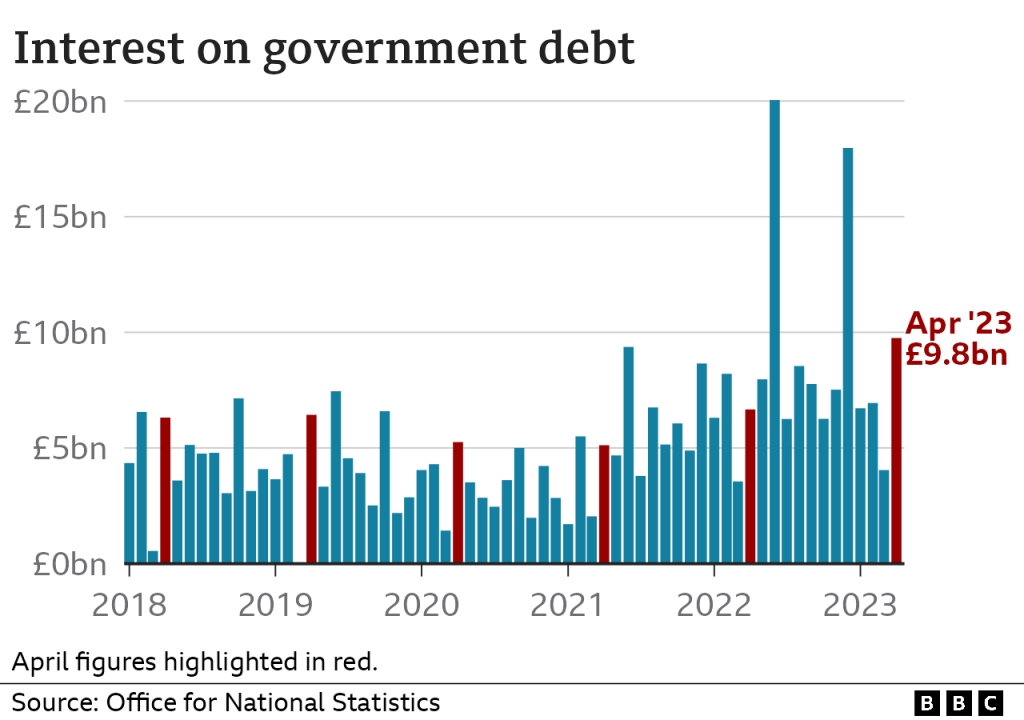

The UK’s debt burden has recently hit a new milestone as interest on the £2.5 trillion debt mountain reached a record high last month. Despite efforts to manage borrowing, the government has added £25.6 billion in debt due to inflation-driven increases in debt charges, rising energy bills, and increased financial support for benefits. In April 2023, borrowing was the second-highest on record after the pandemic-caused surge in 2020, exceeding last year’s figure by £11.9 billion.

UK’s Record Debt Interest and Striving for Fiscal Stability amid Challenges

According to the Office for National Statistics, debt interest alone amounted to £9.8 billion in April, the highest figure recorded since data collection began in 1997. Chancellor Jeremy Hunt justified the substantial borrowing during the pandemic and global energy crisis but acknowledged that the current debt and borrowing levels are concerning. The government has prioritised reducing the debt burden by implementing measures to stimulate economic growth and reduce debt levels. Despite concerns over rising debt, the latest borrowing figure exceeded economists’ expectations by £7.7 billion and surpassed the Office for Budget Responsibility (OBR) predictions by £3.1 billion. However, there is a positive development as the ONS reported that borrowing for the fiscal year ending in March was £137.1 billion, which is £15.3 billion less than the OBR’s forecast. This suggests progress in managing overall borrowing levels in the broader context.

The Role of Bonds in Stimulating Economic Growth and Financing Projects

The government borrows money primarily because its income from taxes may only sometimes be sufficient to cover all its expenses. While raising taxes or cutting spending are options, they can negatively impact the economy, such as reduced consumer spending and lower business profits. Borrowing is often seen as a means to stimulate economic growth and finance significant projects like infrastructure development. To borrow money, the government sells bonds known as “gilts.” These bonds promise future repayment along with regular interest payments. UK government bonds are considered secure and purchased by domestic and international financial institutions. The Bank of England has also used quantitative easing by buying government bonds to support the economy.

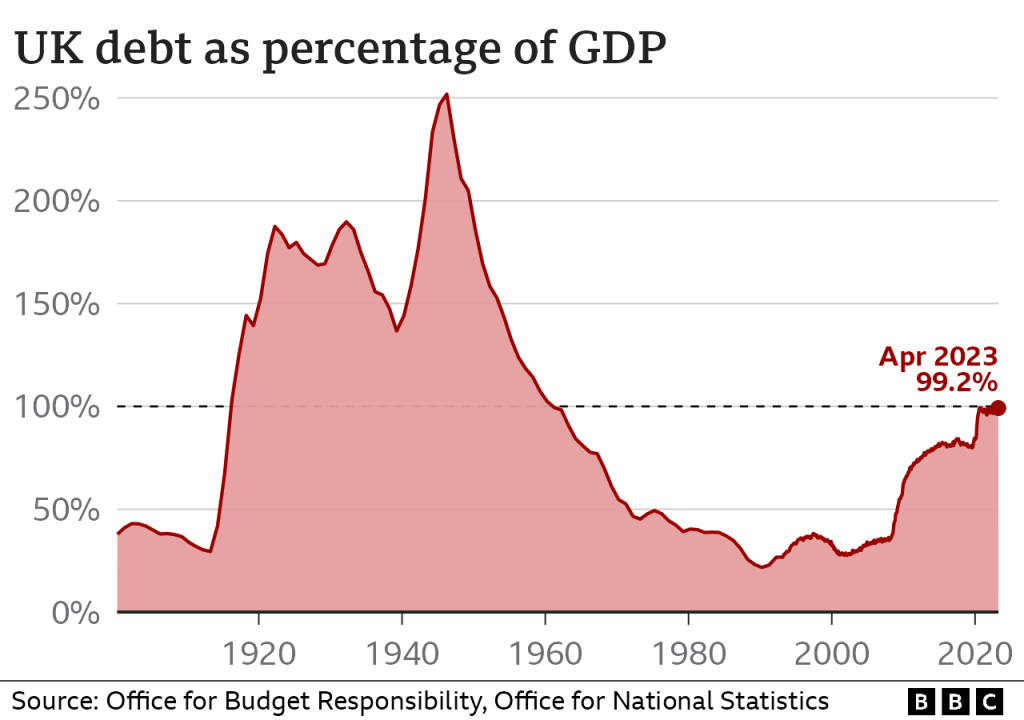

Trends, Implications, and Interest Payments of Government Borrowing

Government borrowing fluctuates monthly, with notable increases during the tax season. In the 2022-23 financial years, the government borrowed £137.1 billion, a 13% rise compared to the previous year. In April, borrowing reached £25.6 billion, the second-highest borrowing figure since records began. The national debt of the UK currently stands at over £2.5 trillion, more than double the levels seen before the 2008 financial crisis. However, the country’s gross domestic product (GDP) debt is still relatively low compared to historical figures and other advanced economies. They are increasing the national debt resulting in higher interest payments for the government. This cost becomes more noticeable as interest rates rise. Record levels of money were allocated for debt interest in 2022 and April 2023.

Striking the Balance between Economic Growth and Fiscal Responsibility

While economists and politicians generally agree that debt cannot indefinitely grow in proportion to the economy, there is debate regarding the speed and manner of reducing borrowing. Growing the economy is seen as a strategy to decrease the debt-to-GDP ratio.

Chancellor Jeremy Hunt attributes the increase in government costs to the pandemic and global events like Putin’s actions in Ukraine. Hunt and Prime Minister Rishi Sunak have highlighted the importance of reducing debt in the medium term. Distinguishing between two words, ‘deficit’ denotes the difference between government revenue and expenses, whereas ‘debt’ refers to the total amount owed over a specified period. The deficit occurs when spending surpasses income and increases debt; conversely, surplus years lead to a decrease in the deficit.

Understanding Mortgage Interest Rates, Future Predictions, and Housing Market Outlook

We are facing fascinating insight into the complex world of UK mortgage interest rates, future predictions, and their potential impact on the housing market. It highlights the factors determining current rates and emphasises the importance of seeking advice from a whole-of-market mortgage broker to secure the best deal based on individual financial situations and deposit amounts.

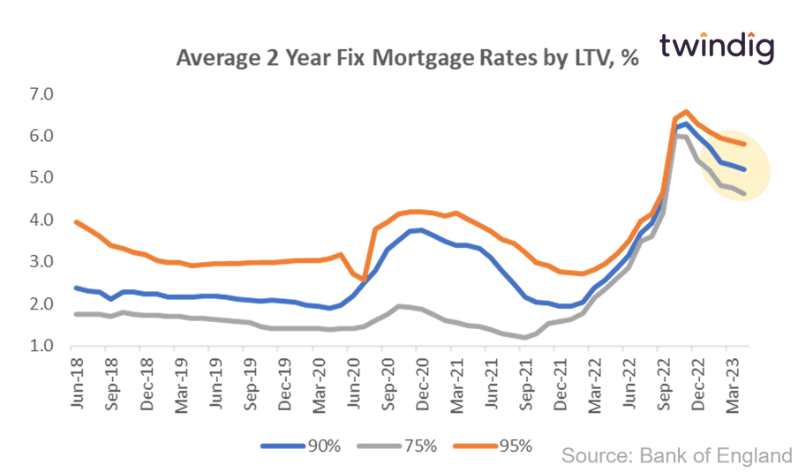

Recent increases in the Bank of England’s base rate due to inflation have led to uncertainty regarding future rate hikes, with projections suggesting a rise to 5% by the end of 2023. Interestingly, despite these increases, fixed-rate mortgages have decreased. It is essential to monitor fluctuations in interest rates and consider fixing or switching mortgage deals accordingly.

While property price growth has slowed, there is no evidence of a significant decline. The future outlook will depend on various factors, including inflation, mortgage rates, and buyer demand. Overall, it is essential to keep abreast of developments in the mortgage market and seek professional advice to make informed decisions.

UK Mortgage Rates, Property Prices, and the Impact on Homeowners

To have an overview of current mortgage interest rates in the UK and their impact on homeowners. It has been highlighted that the average rates for different mortgage types, the increase in lenders’ standard variable rate (SVR), and the reduction in available mortgage deals. The effects of rising interest rates on variable and fixed-rate mortgage holders highlight the decline in UK property values according to significant house price indices. It briefly explains the reasons behind interest rate hikes and mentions upcoming changes in the energy price cap.

Exploring the Link Between Average Mortgage Rates and the UK’s Economic Outlook

The correlation between the UK’s economic forecast and the variability in average mortgage rates is discussed in this piece. It also examines the influence of Rishi Sunak, who has been consistent in his approach to managing the economy as Chancellor of the Exchequer. Nevertheless, Kwasi Kwarteng’s introduction of a mini-budget initially caused instability in financial markets, leading to apprehensions of increased mortgage rates. However, subsequent policy changes have allayed market concerns. Due to the Bank of England’s rising Bank Rate, average mortgage rates for new businesses have increased and are predicted to continue growing amid economic uncertainties.

UK’s record-high debt burden and its impact on borrowers’ Decision-making

Given the UK’s record-high debt burden, fueled by various economic challenges such as increased borrowing, the pandemic, and an energy crisis, it is crucial to focus on reducing the deficit while fostering economic growth. Although borrowing increased in April, efforts to manage the debt have resulted in lower-than-anticipated borrowing for the previous fiscal year. Homeowners and potential buyers need to stay up-to-date with mortgage interest rates, as rate increases are expected by the end of 2023. Monitoring inflation, mortgage rates, and housing market demand will enable borrowers to make informed decisions.

The appointment of Rishi Sunak as Prime Minister brings some stability and potentially limits future Bank Rate increases, but average mortgage rates are still expected to rise as the Bank of England addresses inflation. Therefore, understanding the relationship between Bank Rates and mortgage rates is essential for borrowers.