Private school tax exemptions have been thoroughly analyzed by the Institute for Fiscal Studies (IFS), reaffirming Labour’s meticulous financial planning and support for their policies. As the economy faces a crisis, concerns arise due to Conservatives’ lack of a growth strategy, prompting deliberation over challenging decisions for the government. To address these concerns, Bridget Phillipson, shadow education secretary, emphasizes Labour’s strong commitment to raising and maintaining superior standards in state schools. This commitment is exemplified through their proactive stance on rectifying tax privileges granted to private schools. Supported by the Nuffield Foundation endorsement, it is suggested in the analysis that imposing Value Added Tax (VAT) on private school tuition fees could be an effective measure.

Labour’s Fully Costed Plans for State Schools

Drawing attention to the imperative of funding Labour’s meticulously budgeted initiatives to enhance state school quality, Bridget Phillipson, the shadow education secretary, underscored this commitment’s significance. As the Conservative government grapples with a coherent growth strategy, Phillipson underlines the urgency for astute fiscal governance in addressing forthcoming challenges. By curtailing unwarranted tax advantages afforded to private schools, Labour seeks to rechannel resources toward advancing public education. Supported by the IFS analysis, this strategy gains traction, with the combined effect of imposing VAT on private school fees and revoking their charitable status shown to potentially generate a substantial sum for bolstering state education.

Leveraging Funding for State Education

Josh Hillman, the education director at the Nuffield Foundation, the research’s sponsor, accentuates the pivotal role of the analysis in cultivating fiscal backing for state education. Although the suggested strategies might yield a commendable yet moderate sum, Hillman emphasises the necessity of judiciously apportioning resources to make noteworthy strides in closing the achievement gap between privileged and underprivileged pupils. He proposes that funding avenues be precisely honed, with investments channelled into empirically grounded initiatives and methodologies. This deliberate approach holds the potential to magnify and prolong the influence of supplementary funding, thus amplifying educational outcomes for students nationwide.

Labour’s Plan to End Private School Tax Breaks

The Institute for Fiscal Studies (IFS) has analysed Labour’s proposal to end tax breaks for UK private schools and its potential impact on pupil migration. The IFS report concludes that the expected mass exodus of students from the private sector is unlikely, with only around 3 per cent of privately educated pupils predicted to move to state schools if the plan is implemented. This figure sharply contrasts with an earlier forecast by a lobby group for independent schools, which had estimated a pupil migration rate of at least 17 per cent. Labour’s ambitious plan includes introducing a 20 per cent VAT on private school fees and eliminating the 80 per cent business rate discount currently enjoyed by private educational institutions. While Labour estimated that these measures would raise £1.6 billion to fund essential policies, the IFS predicts a more conservative net gain of £1.3 billion to £1.5 billion, considering potential increased state spending on the limited number of pupils transitioning from independent to state schools.

Assessing Labour’s Plan to End Private School Tax Breaks

The IFS analysis sparks debate over Labour’s plan to end private school tax breaks. Shadow education secretary Bridget Phillipson defends the proposal, asserting minimal impact on pupil numbers. However, the Independent Schools Council (ISC) challenges the IFS’s estimate, anticipating a higher outflow. Experts warn that predicting pupil movement and funding implications is complex, considering factors like location and endowment. Founder of EDSK, Tom Richmond, highlights varying impacts on private schools. The report emphasises evidence-based planning for education policies and financial strategies amidst ongoing discussions.

Tax Exemptions from Private Schools on Pupil Numbers and Potential Revenue Gain

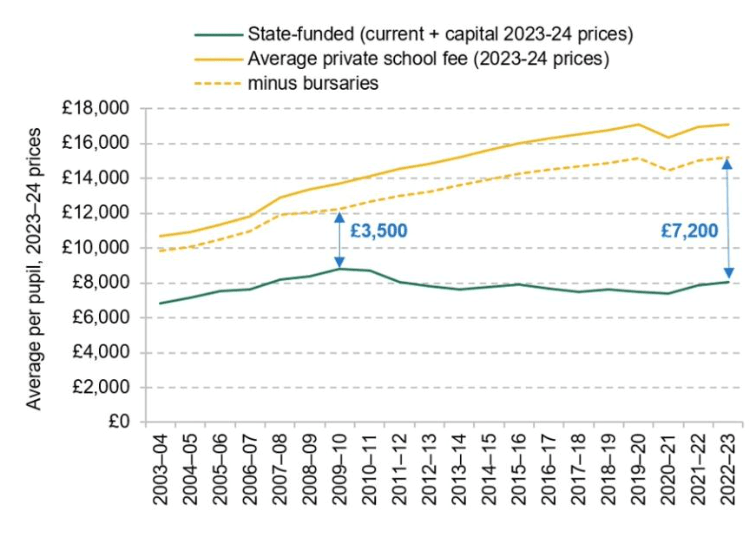

Experts from the Institute for Fiscal Studies (IFS) suggest that removing tax exemptions from private schools will likely avoid a significant shift in pupil attendance to state schools. The IFS report estimates that a few pupils would move to the state sector if Value Added Tax (VAT) is imposed on school fees. The Labour Party’s proposal to end tax breaks for private schools could raise £1.5 billion in extra tax revenue annually. The research, funded by the Nuffield Foundation, projects a 3 to 7 per cent decrease in private school attendance, leading to a net gain of £1.3 billion to £1.5 billion in public finances each year. The report also highlights the widening gap between average private school fees and state school spending per pupil, emphasising the need for additional funding to support state schools.

Comparative Analysis of State School Spending and Private School Fees in England

The provided graph visually represents the complete per-pupil spending in state-funded schools across England from 2003–04 to 2022–23. Notably, these values surpass those detailed in Sibieta’s study (2023) due to their encompassing ongoing and capital expenditures, a consideration stemming from private schools’ duty to fund capital outlay. Furthermore, the graph compares the mean daily fee charged by private day schools within the same timeframe, excluding boarding expenses. The data is exhibited before and after, including estimated bursaries and scholarships, given that these are extended to over one-quarter of students. Within Figure 2, there is an illustration of the percentage deviation between the per-pupil expenditure in the state sector and the tuition fees of private schools (accounting for bursaries and scholarships). This representation accentuates the variance as a proportion of the state sector’s per-pupil spending.

Impact of Removing Tax Exemptions from Private Schools

The report examines Labour’s proposal to end tax exemptions for private schools, estimating an annual revenue of £1.6 billion. Potential changes in pupil attendance and its impact on tax revenues are discussed, with state schools possibly requiring £100-300 million per year in additional funding if students switch from private to state education. The overall net gain from the proposal is projected to be approximately £1.3-£1.5 billion per year, potentially enabling a 2% increase in day-to-day state school spending, with a focus on disadvantaged pupils. Long-term effects on earnings and inequalities are considered, acknowledging that private school attendance may lead to higher wages, but the reasons behind this association are uncertain. The report concludes that while the policy may achieve its goal of increasing revenue, its impact on encouraging pupil migration to the state sector and reducing school-based inequalities is expected to be minor.