the most significant drop in living standards since the 1950s.

Britain has been facing the most significant drop in living standards since the 1950s. Britons will pay 73% more energy bills this year. Gasoline prices have increased by 30% and diesel prices by 36% compared to last year. Britain is headed for its most significant energy price shock & Cost of living crisis since the 1970s.

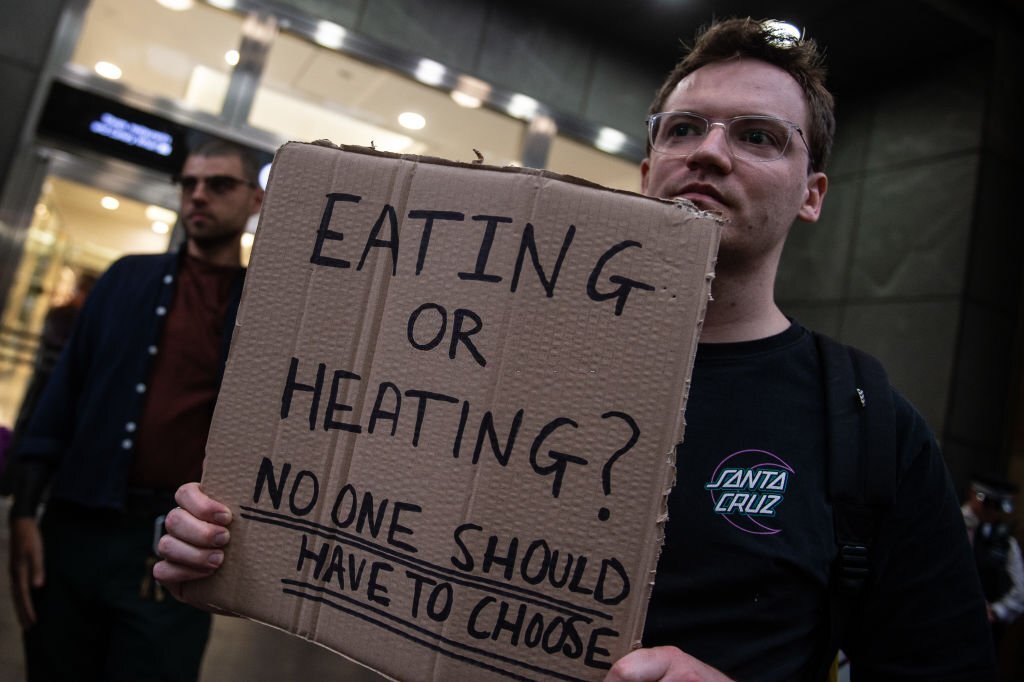

Cost of living crisis 2022

The sixth-richest country in the world faces a winter of humanitarian crisis. Unless the government acts now, millions of Britons will be unable to keep their homes warm. As the NHS warns, some will die while others fall seriously ill. Schools, hospitals, and care homes across the country must choose between busting their budgets or freezing. Countless shops and businesses will close, never to open again. More than 70% of pubs are preparing for the last orders.

At the same time, any restaurant, cafe, chippy, or kebab shop must now face an existential threat, thanks to a quadrupling of their energy bills, surging food prices, and a recession that will kill discretionary spending. As economic catastrophes go, this looks far bigger than the 2008 crash. It promises to reshape our everyday lives and social fabric. Living standards in the UK are set for their most significant drop on record thanks to a perfect storm of rising inflation, the economic hit of the pandemic, and Russia’s invasion of Ukraine, the UK’s fiscal watchdog has said.

According to the Office for Budgetary Responsibility (OBR), wages are failing to keep up with rising prices, as rapidly growing energy prices push inflation towards 9%, its highest level in 40 years. According to the OBR, Russia’s invasion of Ukraine has had “major repercussions for the global economy, Omicron, supply bottlenecks, and rising inflation were already buffeting whose recovery from the worst of the pandemic”.

The war has left oil and gas prices far higher than their historical averages – a fact that will “weigh heavily on a UK economy that has only just recovered its pre-pandemic level. The OBR said in its report released on Wednesday. Higher energy bills will lead to further inflation, putting pressure on household consumption and eroding incomes. Coupled with rising taxes, this fall in spending power will lead to a decline of 2.2% in living standards this year and next – the most significant fall on record. As a result, living standards will not recover to their pre-pandemic level until 2024-25.

What are the causes of the cost of living crisis in the UK?

Both global and local factors have contributed to the UK’s cost of living crisis. According to Bank of England governor Andrew Bailey, about 80% of the causes driving the cost of living are global. These include the various forms of instability the world experienced in the early 2020s, such as the COVID-19 pandemic, a chip shortage, an energy crisis, a supply chain crisis, and Russia’s invasion of Ukraine. The UK was reported to be among the worst affected among the world’s advanced economies. In 2021, the UK’s inflation was less than that of the US. Still, high US inflation was not generally experienced as a cost of living crisis due to the stimulus cheques distributed to American households. Though in 2022, the cost of living was also reported as a global phenomenon, having impacts that include those living in the US and across Europe and risking an “apocalyptic” impact for those in the developing world.

Causes unique to the UK include labour shortages related to foreign workers leaving due to Brexit and additional taxes on households. Factors that have worsened the crisis since 1 April 2022 include Ofgem increasing the household energy price cap by 54%, an increase in National Insurance, and a rise in Council Tax.

Unemployed people in the UK receive lower fiscal support than the average for OECD countries, and UK salaries have not risen substantially since the financial crisis of 2007–2008. Insufficient long-term gas storage facilities resulted in the UK energy prices being overexposed to market fluctuations. Household income, whether from wages or benefits, has not generally kept pace with rising costs.

In April 2022, UK real wages fell by 4.5%, the sharpest fall since records began back in 2001. By July 2022, inflation had risen to over 10%, the highest level in 40 years, and the Bank of England was forecasting it could reach 13% by the end of the year. Energy costs for the typical British household were expected to rise 80% from October 2022, from £1,971 to £3,549, until prime minister Liz Truss announced measures to limit these increases.

Why are energy prices rising so much?

This winter’s expected surge in UK energy prices is being described as a national emergency, posing at least as significant a financial threat as the coronavirus pandemic. The upcoming increase in a regulator-set limit on consumer energy bills is predicted to push a majority of households into fuel poverty and put a strain on budgets that could hammer industries like hospitality, travel, and retail. Consultancy Auxilione published a revised forecast for the cap, which almost all energy suppliers are charging, predicting an increase in its current rate of £1,971 ($2,348) a year to £3,635 for the three months from 1 October. In the following quarters, it says the cap could hit £4,650 and £5,456 without intervention, taking it to more than a fifth of the median UK income. The average household paid £1,400 for its energy in October 2021.

Global wholesale gas and electricity prices were already rising in 2021 due to higher demand as economies reopened from Covid-19 lockdowns and competition between regions intensified. Russia’s invasion of Ukraine in February led to sharp cuts in gas supplies to Europe, sending European natural gas prices to a record high and triggering a rise in electricity prices, too. Even though the UK gets only 3% of its gas from Russia, versus around 35-40% across the European continent, it’s connected by pipeline to the rest of Europe and is a net importer.

The UK has an exceptionally high gas demand, as it has a more significant proportion of homes heated with gas than most European countries and generates about a third of its electricity from burning natural gas. “High electricity prices have exacerbated the impact in Europe, where drought conditions have affected hydropower plants and unplanned outages have reduced French nuclear output,” Joanna Fic, the senior vice president, said.

Fall of Living standards in Britain

Living standards in Britain are expected to fall at the fastest annual rate since the mid-1950s. According to the government’s independent economic forecaster, they will take until at least 2024 to return to pre-Covid levels. Despite the measures announced by Rishi Sunak in his spring statement, the Office for Budget Responsibility (OBR) said real household disposable incomes per person would fall by 2.2% in 2022-23 as earnings from work fail to keep pace with soaring inflation. It said the fall would be the biggest in a single financial year since modern records began in 1956-57 and that it would take until 2024-25 for inflation-adjusted living standards to return to their pre-pandemic level.