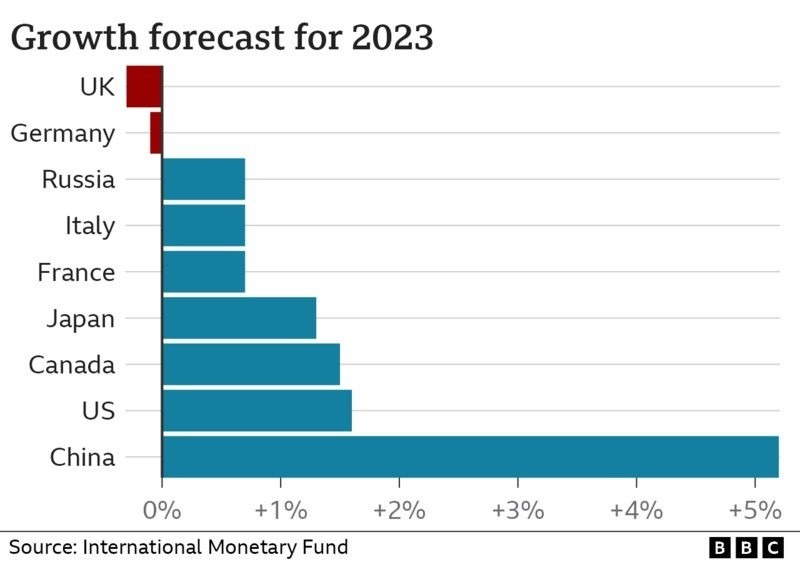

The UK is expected to fall behind leading G7 countries as the IMF warns of a shrinking economy this year. The Washington-based organization cites rising energy costs and higher inflation as particularly affecting the UK and euro area. Global growth could slow to just 1% if recent banking issues in the US and Switzerland signal a severe financial crisis. However, the latest forecast shows a 0.3% contraction in UK GDP, an improvement from the earlier prediction of a 0.6% decline. Despite this, the UK remains the world’s worst-performing large economy, according to the IMF’s latest World Economic Outlook.

Introduction

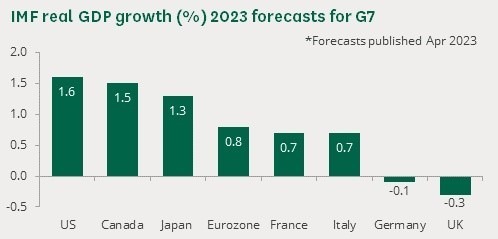

The UK economy is expected to perform poorly this year, falling behind other G7 nations due to rising energy costs and higher inflation. The IMF warns of the risks of a hard landing for developed nations, highlighting the UK and euro area. Recent banking issues in the US and Switzerland could further slow global growth to 1%. Despite a slight upward revision, the UK’s GDP is still projected to contract by 0.3%. Chancellor Jeremy Hunt sees it as a positive sign, while Rachel Reeves highlights the negative impact on families’ living standards. Layla Moran points out additional costs and red tape due to Brexit. The IMF predicts only the UK and Germany will experience contraction in 2023, with no early relief from the UK’s cost of living crisis, and expects modest growth coinciding with the general election.

Forecasts which lead the PM into a tricky situation

The UK is expected to face the sharpest decline among major economies, albeit slightly less than previously predicted, according to the International Monetary Fund (IMF). The organization forecasts a 0.3% contraction in British GDP for 2023, an improvement from the earlier estimate of 0.6%. Germany is also expected to shrink by 0.1%. Despite signs of resilience in early 2023, the UK’s contraction remains the largest among G20 nations. Finance Minister Jeremy Hunt emphasized the positive aspect of the forecast compared to other G7 nations. The Bank of England expects slight growth in Q2. Ahead of an expected election, Prime Minister Rishi Sunak and Hunt face pressure to boost economic growth, although they prioritize reducing inflation over tax cuts. The IMF projects UK inflation to average 6.8% in 2023, still above the Bank of England’s target and the highest among G7 countries. For 2024, the IMF forecasts a 1.0% growth for the UK, lower than most G7 economies except Italy but on par with Japan.

UK’s Advanced Economy Faces Pandemic Rebound Challenges

The UK economy is projected to have the poorest performance among the G20 economies in 2023, including Russia, despite a slight upgrade from the previous forecast by the IMF. The IMF also cautioned about the global financial system following recent banking collapses and takeovers. The UK was predicted to experience a downturn and rank last among the G7 advanced economies. In 2022, the UK led the group during the pandemic rebound. The IMF expects a 0.3% shrinkage in the UK economy for 2023, with a 1% growth forecasted for the following year. While economic forecasts provide guidance, they are only sometimes accurate predictors. The impact of low change under the current government affects families, leading to concerns about mortgage penalties and declining living standards.

Impeding Factors Threaten Economic Expansion

According to the Liberal Democrat Treasury spokesperson Sarah Olney, the forecast was “another damning indictment of this Conservative government’s record on the economy”. Several forecasters show that the chances of a recession in the UK this year are declining. An economy is usually said to be in recession if it shrinks for two consecutive three-month periods. The independent Office for Budget Responsibility expects the economy to contract by 0.2% this year but avoid a recession. According to recent statements by the Bank of England’s governor, Andrew Bailey, he expressed optimism for the economy and stated that it is not currently on track for an immediate recession.

IMF Projections and Worries in the Face of Global Economic Recovery and Fragile Banking System

The latest forecasts come amid the ongoing recovery of the world economy from the pandemic and Ukraine war energy shock. However, the IMF expressed concerns about the broader impact of recent fragility in global banking markets. The organization expects global growth to decline from 3.4% in 2022 to 2.8% in 2023 before gradually rising and stabilizing at 3% over the next five years. It also cautioned that if more stress in the financial sector exists, global growth could weaken further this year. In response to surging food costs and escalating energy prices, several countries including the UK, US, and Europe have raised their interest rates as a measure to control inflation, which refers to a continuous increase in prices of goods and services over time. In fact, inflation in the UK has reached its highest level in nearly 40 years. Last month, the Bank of England increased interest rates to 4.25% to address this issue.

Concerns can increase when we face the statistics

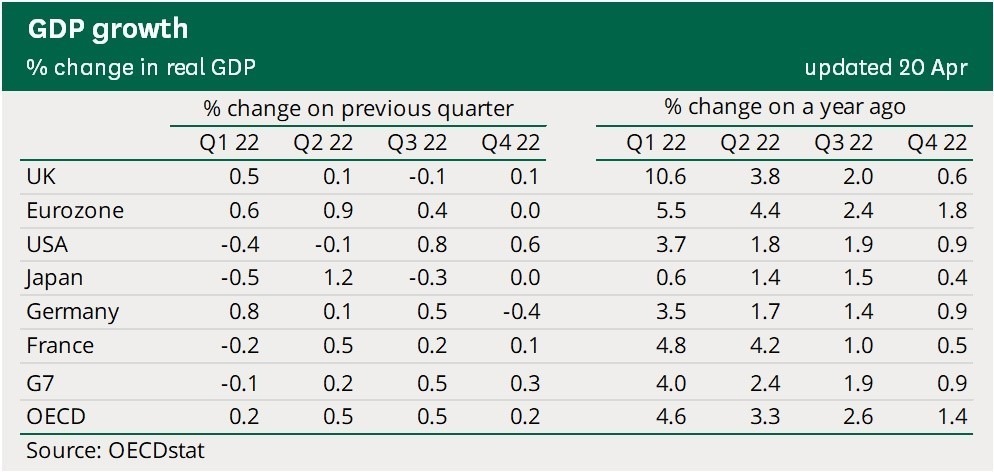

Latest GDP data for G7 economies in Q4 2022, UK GDP growth was 0.1% compared with the previous quarter (Q3 2022). The eurozone recorded no growth, with GDP in Germany down by 0.4%, while France saw growth of 0.1%. US GDP growth was 0.6%.

GDP growth in recent years

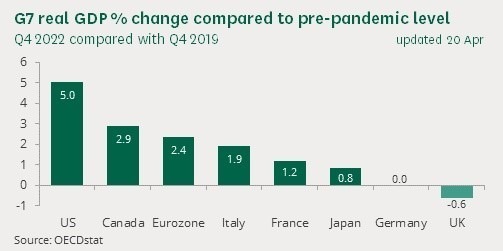

Compared to the pre-pandemic level, UK GDP in Q4 2022 was 0.6% lower. In comparison, the GDP of the Eurozone is currently 2.4% higher than its level before the pandemic, whereas the GDP of the US has risen by 5.0%.

IMF and OECD forecasts

On 11 April, the IMF published new forecasts for the world economy. The IMF expects inflation rates to slow, albeit less than anticipated, in January. The IMF forecasts the UK GDP to fall by 0.3% in 2023, the lowest figure in the G7, with a growth of 1.0% in 2024. The IMF stressed the high degree of uncertainty over the global economic outlook.

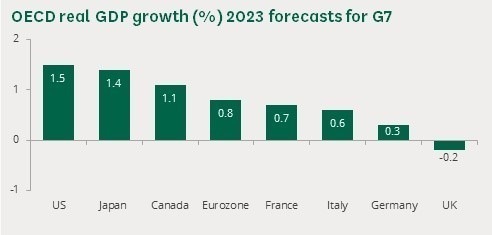

OECD Forecasts: Fragile Global Economy, UK’s Lowest G7 GDP

On 17 March, the OECD published new forecasts for the world economy. It says there are recent improvements and upgraded GDP growth forecasts for most countries. The OECD warned, though, that the outlook remained fragile and uncertain. The OECD forecasts UK GDP to fall by 0.2% in 2023, the lowest figure in the G7.

Global Economy Loses Momentum and UK Predicted to be Worst-Performing Major Economy in 2023

As policymakers gather in Washington for their meetings, there is a growing concern that the global economy may have lost momentum. According to the latest forecast, one of the reasons for the decline in the long-term global growth rate is China’s transition into higher-income nations, leading to a naturally slower growth rate. Despite an upgrade in its forecasts, the UK is still expected to be the worst-performing major economy globally this year. The International Monetary Fund (IMF) projects a contraction of 0.3% in UK GDP for 2023, which is an improvement from the earlier forecast of a 0.6% decline. In contrast, Russia is forecasted to achieve a 0.7% growth despite facing extensive sanctions during the Ukraine war. Additionally, the UK’s GDP is predicted to shrink more than Germany’s, which is also struggling to recover from the recession and cope with surging energy prices. The IMF downgraded Germany’s growth projection from 0.1% to a 0.1% contraction in January.